International Finance

IIEP and its faculty specialize in the study of international finance, providing in-depth research on global markets, monetary policy, international firms, and governance institutions. IIEP and its faculty publish books, articles, working papers, and op-eds that contribute to global research and policy on corporate finance, foreign direct investment, econometrics, taxes, and emerging markets. IIEP also hosts many events and workshops related to international finance, including the annual Washington Area International Finance Symposium (WAIFS), a Macro-International seminar series with the GW Economics Department, and the bi-annual Wenger Family Lecture on International Business and Finance.

View all ARCHIVED papers in this category.

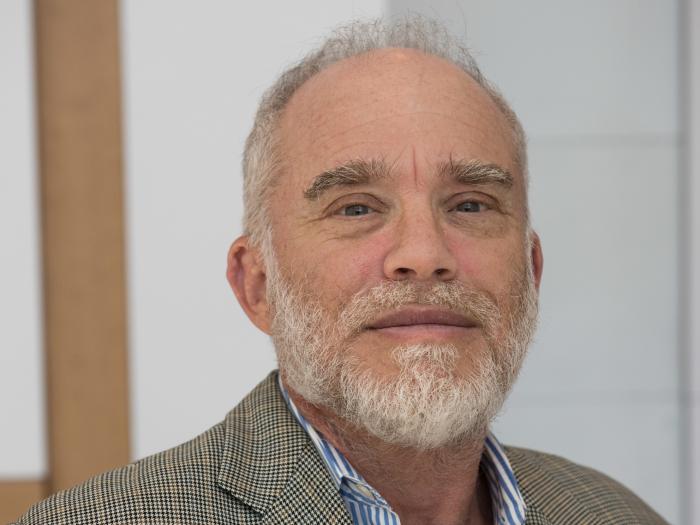

Professor of Finance and Chief Diversity Officer

Professor of Economics and International Affairs

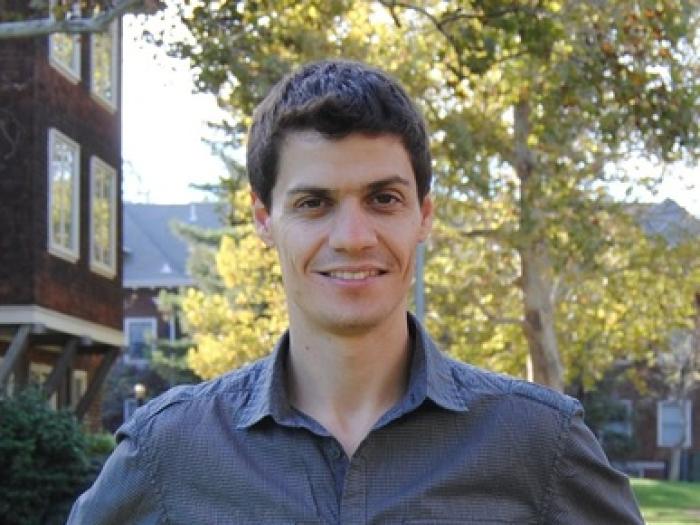

Associate Professor of International Business and International Affairs

Assistant Professor of Economics

Professor of Economics and International Affairs

Associate Professor of Political Science and International Affairs

Professor of International Business and International Affairs

Former Director, Professor of Economics and International Affairs

Assistant Professor of Political Science and International Affairs

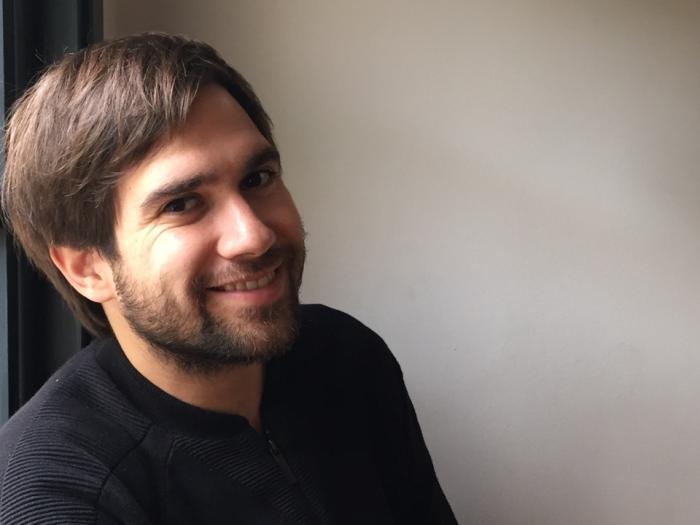

IIEP Distinguished Visiting Scholar; Senior Associate, Council on Economic Policies, Switzerland, 2020-Present; Former Assistant Director for the Research Department at the International Monetary Fund

Professor of Economics and International Affairs

Associate Professor of International Business and International Affairs and Director, Center for International Business Education and Research (GW-CIBER)

Associate Professor of Economics

Assistant Professor of International Business

Professor of International Business, Public Policy and Public Administration, and International Affairs

Associate Professor of Economics and International Affairs

November 9, 2015 - 8:45 AM

IMF Africa Regional Economic Outlook Discussion

April 23, 2015 - 9:00 AM

Digital Payments/Currencies: Global Threat or Opportunity?

April 9, 2015 - 3:00 PM

The I Theory of Money

April 11, 2014 - 12:30 PM

“Cross-Border Banking and Global Liquidity” (International Finance Forum Series)

October 24, 2013 - 12:00 PM

International Finance Forum Series

February 12, 2013 - 12:30 PM

The Surprisingly Swift Decline of U.S. Manufacturing Employment

November 14, 2012 - 2:30 PM

The Real Exchange Rate, Real Interest Rate, and Risk Premium

May 26, 2011 - 8:15 AM

Advances in Behavioral Finance

March 17, 2011 to March 18, 2011

19th Symposium of the Society for Nonlinear Dynamics and Econometrics

February 28, 2011 - 12:30 PM

Self Interest, Altruism, and Super-Altruism in Foreign Aid: A Theoretical Model and Empirical Test

May 26, 2010 - 8:15 AM

Financial Regulation and Supervision: Lessons from the Crisis