Yunus Initiative on Extreme Deprivation

We live in a world of great inequalities in key dimensions of wellbeing–on education, health, income and personal control or agency–where much of the population is well-situated but others are trapped by multiple deprivations and poverty. Through his tireless work on behalf of the poor, Dr. Muhammad Yunus has illuminated many pathways out of poverty by making credit inclusive, encouraging the creation of social and human capital, breaking down traditional gender barriers, envisioning the poor as entrepreneurs, and inspiring hope.

Yunus theorized in 1976 that a lack of credit was trapping individuals in the cycle of poverty in Bangladesh and began making informal microloans through what would become Grameen Bank. By 1983, Yunus had refined his microfinance model and officially founded Grameen Bank as an independent financial institution. Grameen Bank effectively challenged conventional wisdom in providing evidence that poor households can benefit greatly from access to credit. With credit provision as a tool of poverty alleviation, lending to the poor does not necessarily lead to economic losses. Yunus and Grameen Bank were jointly awarded the Nobel Peace Prize in 2006 for pioneering the concept of microcredit and microfinance. Today, Grameen Bank serves more than 45 million people through 10.64 million borrowers.

International interest in Yunus’ work increased greatly after he received the Nobel Prize. The Yunus Centre was founded in July 2008 to promote and disseminate Yunus’ philosophy and function as a resource center for microfinance and social business activities in Bangladesh and globally. Today, there are more than fifty Yunus Centers at universities around the world.

The Yunus Initiative on Extreme Deprivation at the Institution for International Economic Policy is the George Washington University’s branch of the Yunus Center. The Yunus Initiative on Extreme Development supports research and events related to extreme deprivation, measurement and multidimensional poverty, and Muhammad Yunus’ revolutionary ideas of microfinance and microcredit, globally and here in Washington, DC. The Initiative is also a proud partner of the GWU-Grameen Bank & Trust Partnership and Student Internship Program in Bangladesh and Nepal.

IIEP’s Yunus Initiative focuses on three key themes:

- Extreme deprivation: How can academic and policy circles better understand what extreme deprivation is in order to create policy solutions that can have an impact on individuals around the world experiencing it?

- Measurement and multidimensional poverty: Understanding what extreme deprivation is requires careful, intentional measurement. Measurement encourages replication, is authentic, and allows for information to be transmitted seamlessly in order to coordinate efforts across stakeholders.

- Microfinance/microcredit: How can we build on Dr. Yunus’ work in order to address extreme deprivation? How can policy solutions leverage both the public sector and private sector to facilitate impact?

The Yunus Initiative supports the following event series and and programs, and the events and faculty associated with the Initiative are listed below:

October 23, 2025 - 5:30 PM

Top Lessons I Have Learned from Muhammad Yunus During the Last 38 Years

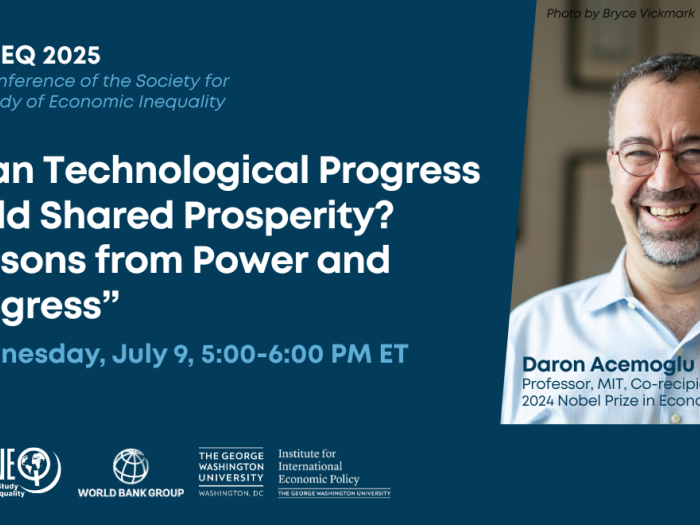

July 9, 2025 - 5:00 PM

ECINEQ 2025 Keynote with Daron Acemoglu

July 8, 2025 - 9:00 AM

Sharing Prosperity: Policy Innovations to Tackle Economic Inequality

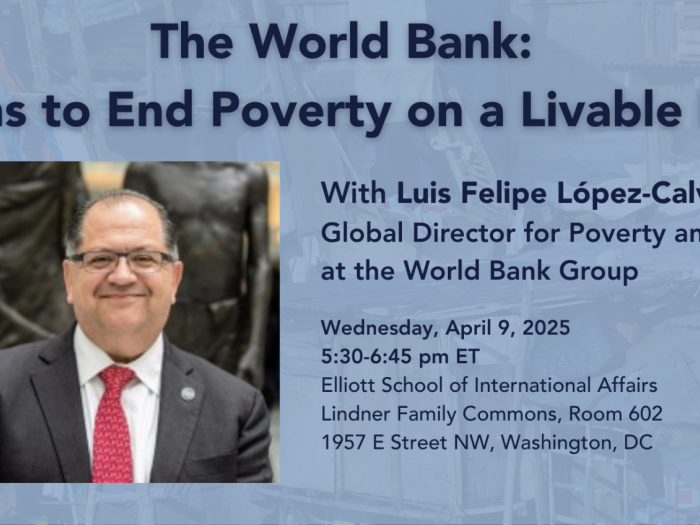

April 9, 2025 - 5:30 PM

The World Bank: Actions to End Poverty on a Livable Planet with Luis Felipe López-Calva