Originally published on July 22, 2012

I am generally not the sort to sign petitions or other declarations, particularly not ones called “manifestos”. Last Friday, however, I ran into the Manifesto for Economic Sense when I read a very interesting post on the IMF’s staff report on the UK by Jonathan Portes (Director, National Institute of Economic and Social Research, London) in his nicely named blog, “Not the Treasury View” (referring to the UK Treasury).

After carefully reading the manifesto yesterday I decided to sign it and write about it here in this post. I have become more and more concerned about the push towards “austerity” by governments around the world at this time when unemployment rates are in general well above their long-run averages. My review of the historical evidence suggests that there is very little reason to think that austerity will do anything but make the global recovery even slower and more painful than it already is. In signing the manifesto I am adding my voice to those of a growing number of economists calling for more government spending rather than less until we recover fully from the Great Recession.

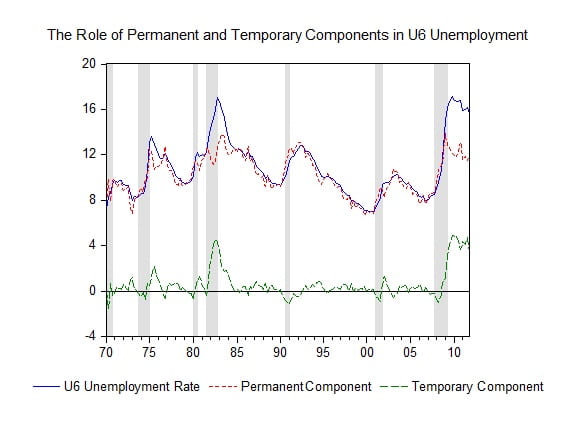

First, here’s an illustrative graph using US data (for many European countries it is even more extreme). The graph shows the broad U6 unemployment rate for the US: “Total unemployed persons, plus all ‘marginally attached’ workers, plus all persons employed part time for economic reasons, as a percent of the civilian labor force plus all ‘marginally attached’ workers.” It also shows my estimates of the contribution of “permanent” movements in this measure as compared to “temporary” movements along with gray bars indicating recessions as dated by the NBER. The model I used is from my paper “Asymmetry in the Business Cycle: Friedman’s Plucking Model with Correlated Innovations.” I apply it here to the U6 unemployment rate to put it in terms of unemployment instead of production, but the results are similar if I use GDP.

According to most economic models, demand-focused policies will only affect the temporary component. You can see that this means that based on the graph above I won’t advocate for these policies very often, but right now is one of those rare times. It currently looks like the US is stuck with over 4 percentage points of excess (broad) unemployment. If we could get more of these people working then they could increase production. Why would economies produce less than their potential? If you ask a business owner, they’ll say they cut back on production when they don’t see enough demand for their products. So, we need demand from somewhere.

We have a simple equation for aggregate demand: (AD): AD = C + I + NX + G. C represents consumption spending by households, I represents investment spending by firms, NX represents net exports, and G represents government spending. So, if AD is already less than what it could be, then we can’t cut back on government spending without further harm to the economy unless at least one of the other three forms of spending taking up the slack. Let’s discuss the options in turn.

First, household consumption. Some very interesting research suggests that having our economy so dependent on consumption spending is one of the reasons we got into the current mess. For their individual well-being, households need to be cutting back on spending, not increasing spending right now.

The US was hoping exports might take up the slack, and there has been some movement in that direction, but now with Europe in their own mess and emerging economies slowing as well, it doesn’t look anyone can depend on exports right now.

In terms of firm investment, firms could be ramping up new projects, but firms won’t produce more if they don’t expect there to be buyers. Since households aren’t in a position to increase spending substantially any time soon, even record-low interest rates can’t entice firms if they don’t see any customers in the mood to buy.

With C, I, NX, and G all looking sluggish, we may be in for a very slow recovery. What about the argument that monetary policy can be used to stimulate the economy and offset the impact of reduced government spending? Central banks are doing what they can, but in the US and Europe they are at the limits of their traditional tools. They can use more unconventional approaches, but they are also finding themselves politically constrained by, in general, the same argument pushing austerity on governments. Furthermore, loose monetary policy over several years does come with some negative side-effects. I’m particularly concerned about households not having the incentive to save. If households are supposed to be cutting down their debt and saving more to put themselves in a better economic position for the future, then we shouldn’t be discouraging that behavior at the same time.

Once the economy fully recovers (which I do believe will happen one way or another eventually, but eventually could be many years out at the rate we’re going), then government spending can and should be reduced. But even when we’re back to producing all we can we don’t actually need to bring the average deficit to zero or have a plan to pay off the debt. Despite the analogies being thrown around by various politicians, governments are not the same as households. Countries are expected to go on in one form or another forever, so they just need to pay the interest on their debt, they never have to pay it off. In fact, there are reasons governments should have at least some amount of debt. For example, US government debt is considered a safe asset that many households want to hold to save for retirement. It’s also the usual way that monetary policy is conducted – buying and selling government bonds – so we need enough government bonds to exist for central banks to conduct their regular business.

Of course we want our governments to choose carefully what to spend on and be responsible with our tax money, but the costs of government spending are incredibly low right now due to low interest rates and the stimulative effect of government spending on the economy when we’re below potential. It seems like now is the perfect time for spending on those projects like roads and other infrastructure that people value. That will be much better for the economy than austerity.