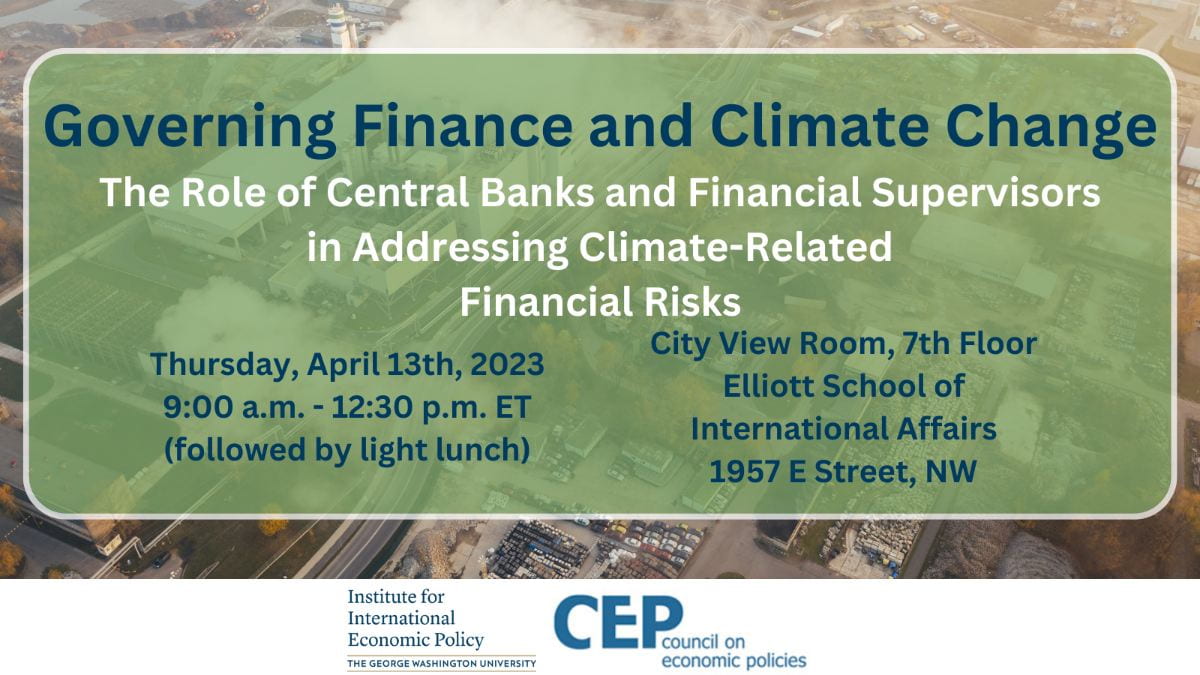

Thursday, April 13th, 2023

9:00-12:30 p.m EDT

In-Person

Central banks and financial supervisors are at the core of mitigating risks to the financial system. To that end, how to respond to the risks from climate change and the transition to a low-carbon economy is rapidly moving up their agendas worldwide. The Central Banks and Supervisors Network for Greening the Financial System (NGFS) now comprises more than 120 authorities from around the globe. Several of them have already started accounting for climate risks in monetary policy and financial supervision. Many more are exploring the next steps.

To take stock of where central banks and financial supervisors stand in addressing the risks from climate change, and discuss policy design and responses, the Institute for International Economic Policy (IIEP) at GWU, in partnership with the Council on Economic Policies (CEP), will be hosting a morning event on “Governing Finance and Climate Change.”

Registration and Coffee: 8.30 – 9.00 AM

Welcome: 9.00 – 9.15 AM

Sunil Sharma. Distinguished Visiting Scholar, Elliott School of International Affairs, GWU; Senior Associate, Council on Economic Policies; and former Assistant Director, IMF

Monetary Policy and Climate Change 9.15 – 10.30 AM

Sarah Bloom Raskin. Distinguished Professor of the Practice of Law, Duke University, Partner, Kaya Advisory Ltd.; former Deputy Secretary, US Department of the Treasury, and former member of the Federal Reserve Board of Governors

Timothy Lane. Former Deputy Governor, Bank of Canada; and former Senior Advisor, IMF

James Talbot. Director, International Directorate, Bank of England; Chair, Workstream on Monetary Policy, Central Banks and Supervisors Network for Greening the Financial System (NGFS)

Break: 10.30 – 11.00 AM

Financial Supervision and Climate Change 11.00 – 12.15 PM

Sarah Dougherty. Director, Green Finance Center, Natural Resources Defense Council

Paul Hiebert. Head, Systemic Risk and Financial Institutions Division, ECB

Mark Levonian. Former Senior Deputy Comptroller of the Currency, and former Federal Reserve official

Closing Remarks: 12.15 – 12.30 PM

William White. Senior Fellow, C.D. Howe Institute, Advisor, Council on Economic Policies, former Chairman of the Economic and Development Review Committee, OECD; former Economic Adviser and Head of the Monetary and Economic Department, Bank for International Settlements; and former Deputy Governor, Bank of Canada

Light Lunch: 12.30 – 13.30 PM

Welcoming Remarks

Sunil Sharma is a Distinguished Visiting Scholar at the Institute for International Economic Policy, Elliott School of International Affairs, The George Washington University, Washington DC, USA, and a Senior Associate at the Council on Economic Policies, Zurich, Switzerland. He was the Assistant Director in the IMF’s Research Department from 2015-2018, and the Director of the IMF-Singapore Regional Training Institute (STI) in Singapore from 2006-2015. Before moving to Singapore in 2006, Sunil was Chief of the IMF Institute’s Asian Division in Washington, D.C. Prior to joining the IMF in 1992, he was on the Economics faculty at the University of California, Los Angeles (UCLA).

Sunil Sharma is a Distinguished Visiting Scholar at the Institute for International Economic Policy, Elliott School of International Affairs, The George Washington University, Washington DC, USA, and a Senior Associate at the Council on Economic Policies, Zurich, Switzerland. He was the Assistant Director in the IMF’s Research Department from 2015-2018, and the Director of the IMF-Singapore Regional Training Institute (STI) in Singapore from 2006-2015. Before moving to Singapore in 2006, Sunil was Chief of the IMF Institute’s Asian Division in Washington, D.C. Prior to joining the IMF in 1992, he was on the Economics faculty at the University of California, Los Angeles (UCLA).

From 2012-2020, he was on the Governing Board of the Mysore Royal Academy (MYRA) School of Business, Mysore, India. During 2012-2018, he was a member of the Advisory Board, Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University, Singapore, and over 2011-2015, he served on the International Advisory Board, The Institute of Global Finance, Australian School of Business, University of New South Wales, Sydney, Australia.

Sunil has a Ph.D. and an M.A. in Economics from Cornell University, a M.A. from the Delhi School of Economics, and a B.A. (Honors) from St. Stephen’s College, Delhi University. He has published widely on economic and financial topics, and his current interests include governance, systemic hazards, complex systems, international financial architecture, and the institutional structure and design of financial regulation.

Monetary Policy and Climate Change: Speakers and Chair

Sarah Bloom Raskin, the former deputy secretary of the U.S. Department of the Treasury, was named the Colin W. Brown Distinguished Professor of the Practice of Law in 2021. She is also a senior fellow in the Duke Center on Risk. Raskin was previously a visiting professor of the practice of law at Duke and a Rubenstein Fellow.

Sarah Bloom Raskin, the former deputy secretary of the U.S. Department of the Treasury, was named the Colin W. Brown Distinguished Professor of the Practice of Law in 2021. She is also a senior fellow in the Duke Center on Risk. Raskin was previously a visiting professor of the practice of law at Duke and a Rubenstein Fellow.

From 2014 to 2017, Raskin was the second-in-command at the Treasury Department, where she was known for her pursuit of innovative solutions to enhance Americans’ shared prosperity, the resilience of the country’s critical financial infrastructure, and the defense of consumer safeguards in the financial marketplace. Earlier, Raskin was a governor of the Federal Reserve Board and a member of the Federal Open Market Committee, where she helped conduct the nation’s monetary policy and promote financial stability. She also served as commissioner of financial regulation for the State of Maryland from 2007 to 2010. She and her agency were responsible for regulating Maryland’s financial institutions during the height of the Great Recession.

Raskin, a graduate of Harvard Law School, has throughout her career worked across public and private sectors in both legal and regulatory capacities. Her work has centered on financial institutions, financial market utilities, consumer protection issues, the adaptation of financial regulatory tools as they pertain to climate risk, bolstered prudential standards, and resolution planning. Her private sector experience includes having served as managing director at the Promontory Financial Group, general counsel of the WorldWide Retail Exchange, and at the law firms of Arnold and Porter and Mayer Brown. Earlier in her career she served as banking counsel for the U.S. Senate Committee on Banking, Housing, and Urban Affairs.

She currently is a member, with Professors Lawrence Baxter and Gina-Gail Fletcher, of the Regenerative Crisis Response Committee, a group of leading experts in law, economics, and public policy focused on the use of fiscal, monetary, and regulatory policies in a climate-transitioned economy.

Timothy Lane served as Deputy Governor from February 2009 until his retirement from the Bank of Canada in September 2022.

Timothy Lane served as Deputy Governor from February 2009 until his retirement from the Bank of Canada in September 2022.

As a member of the Bank’s Governing Council, he shared responsibility for decisions with respect to monetary policy and financial system stability, and for setting the strategic direction of the Bank. He oversaw the Bank’s funds management and currency functions — notably including the Bank’s ongoing research and analysis of developments in financial technology, crypto-assets and digital currencies.

Mr. Lane’s responsibilities as Deputy Governor covered a series of different areas. From 2014 through July 2018, he was responsible for the Bank’s analysis of international economic developments in support of monetary policy decisions — serving as the Bank’s G7 and G20 Deputy. Previously, he was responsible for overseeing the Bank’s work on financial markets (2010–13) and its analysis of Canadian economic developments (2009–10). He joined the Bank in August 2008 as an Adviser to the Governor.

Prior to joining the Bank, he served for 20 years on the staff of the International Monetary Fund (IMF) in Washington, DC. During that period, he worked on a wide range of issues and contributed to the IMF’s work on a number of countries. He has published research on various topics including monetary policy, financial crises, IMF reform, and economic transition. During 2004–05, Mr. Lane was a Visiting Fellow at the University of Oxford. He has also served as Assistant Professor of Economics at Michigan State University (1984-88) and at the University of Iowa (1983-84).

Born in Ottawa, Mr. Lane received a BA (Honours) from Carleton University in 1977 and a PhD in economics from the University of Western Ontario in 1983.

James Talbot is Director of the International Department at the Bank of England. He is also the Chair of the Workstream on Monetary Policy of the Central Banks and Supervisors Network for Greening the Financial System (NGFS). James’ other roles at the Bank of England have included: Head of Monetary Assessment and Strategy Division, advising the MPC on Monetary Policy tools, implementation and strategy; working as a senior adviser on domestic and European macroprudential policy issues; and leading the preparation of the MPC’s quarterly UK forecast. James was UK Alternate Executive Director at the IMF from September 2008- September 2010.

James Talbot is Director of the International Department at the Bank of England. He is also the Chair of the Workstream on Monetary Policy of the Central Banks and Supervisors Network for Greening the Financial System (NGFS). James’ other roles at the Bank of England have included: Head of Monetary Assessment and Strategy Division, advising the MPC on Monetary Policy tools, implementation and strategy; working as a senior adviser on domestic and European macroprudential policy issues; and leading the preparation of the MPC’s quarterly UK forecast. James was UK Alternate Executive Director at the IMF from September 2008- September 2010.

Alexander Barkawi is the founder and director of CEP. Prior to his decision to build up CEP, he was the managing director of SAM Indexes and thus responsible for developing the Dow Jones Sustainability Indexes (DJSI) into a key reference point for sustainability investing. Before joining SAM, Alex took the lead in internationalizing the activities of oikos – an organization that today promotes sustainability in teaching and research of economics and management at more than 40 universities worldwide. Alex is a graduate in economics (M.A.) of the University of St. Gallen, Switzerland, where he also wrote his PhD thesis on “Social Change in Egypt in the 1990s”. He grew up in Germany and Egypt and today lives in Zurich, Switzerland.

Alexander Barkawi is the founder and director of CEP. Prior to his decision to build up CEP, he was the managing director of SAM Indexes and thus responsible for developing the Dow Jones Sustainability Indexes (DJSI) into a key reference point for sustainability investing. Before joining SAM, Alex took the lead in internationalizing the activities of oikos – an organization that today promotes sustainability in teaching and research of economics and management at more than 40 universities worldwide. Alex is a graduate in economics (M.A.) of the University of St. Gallen, Switzerland, where he also wrote his PhD thesis on “Social Change in Egypt in the 1990s”. He grew up in Germany and Egypt and today lives in Zurich, Switzerland.

Financial Supervision and Climate Change: Speakers

Sarah Dougherty focuses on financial regulations related to climate change and green banks, as well as growing finance and economics expertise within NRDC. Before joining NRDC in 2015, Dougherty worked at the Federal Reserve Bank of Atlanta where she held various roles, including as a research analyst covering the energy industry, writing monetary policy briefs, and leading economic education in public affairs. She also helped to create the Green Bank Network of existing green banks, served on the Washington, D.C., Green Bank Advisory Committee to set up a city-level green bank, and worked in Chile and Mexico to support the nations’ green finance efforts. Other previous work includes positions at the Coalition for Green Capital, C2ES (a small solar EPC firm), and the Federal Home Loan Bank of Atlanta. Dougherty holds a master’s degree in economics and is based in Atlanta.

Sarah Dougherty focuses on financial regulations related to climate change and green banks, as well as growing finance and economics expertise within NRDC. Before joining NRDC in 2015, Dougherty worked at the Federal Reserve Bank of Atlanta where she held various roles, including as a research analyst covering the energy industry, writing monetary policy briefs, and leading economic education in public affairs. She also helped to create the Green Bank Network of existing green banks, served on the Washington, D.C., Green Bank Advisory Committee to set up a city-level green bank, and worked in Chile and Mexico to support the nations’ green finance efforts. Other previous work includes positions at the Coalition for Green Capital, C2ES (a small solar EPC firm), and the Federal Home Loan Bank of Atlanta. Dougherty holds a master’s degree in economics and is based in Atlanta.

Paul Hiebert heads the Systemic Risk and Financial Institutions Division of the European Central Bank (ECB). In this role, he leads systemic risk analysis for the euro area feeding into the ECB’s flagship Financial Stability Review, as well as macroprudential policy for the largest euro area banks. Since 2019 he has been leading climate-related risk and financial stability analysis with the corresponding publication of the ECB’s and ESRB’s annual report. His current role builds on over 20 years of experience within the ECB, the International Monetary Fund, the Reserve Bank of Australia and the Canadian Department of Finance in various capacities—spanning economic, financial and policy functions for a wide range of countries. He has published on a diverse set of topics, including financial cycles, global banking, climate change issues, macroprudential policy, housing markets, and fiscal policy. He holds an M.A. in Economics from McGill University in Montréal.

Paul Hiebert heads the Systemic Risk and Financial Institutions Division of the European Central Bank (ECB). In this role, he leads systemic risk analysis for the euro area feeding into the ECB’s flagship Financial Stability Review, as well as macroprudential policy for the largest euro area banks. Since 2019 he has been leading climate-related risk and financial stability analysis with the corresponding publication of the ECB’s and ESRB’s annual report. His current role builds on over 20 years of experience within the ECB, the International Monetary Fund, the Reserve Bank of Australia and the Canadian Department of Finance in various capacities—spanning economic, financial and policy functions for a wide range of countries. He has published on a diverse set of topics, including financial cycles, global banking, climate change issues, macroprudential policy, housing markets, and fiscal policy. He holds an M.A. in Economics from McGill University in Montréal.

Mark Levonian was most recently Managing Director and Global Head for Enterprise Economics and Risk Analysis at Promontory Financial Group. He was formerly Senior Deputy Comptroller for Economics at the US Office of the Comptroller of the Currency (OCC), where he served as a key advisor to the Comptroller before, during, and after the global financial crisis. Mark oversaw quantitative examination support and policy research for the OCC and was closely involved in policy responses to the financial crisis, including the development of bank stress testing. As a senior regulatory official and economist, he led or participated in various Basel Committee initiatives related to economic modeling and played a leading role in the development of rules and guidance for multiple generations of the Basel capital framework. Prior to joining the OCC, Mark was Vice President for Banking Supervision and Regulation and Economic Research Officer at the Federal Reserve Bank of San Francisco, Manager of the Banking Studies Department at the New York Fed, Lecturer in Finance at the University of California’s Haas School of Business, and Senior Economist at the Reserve Bank of Australia. He has been an adviser/consultant to the World Bank, the IMF, and the central banks of Russia and Belarus.

Mark Levonian was most recently Managing Director and Global Head for Enterprise Economics and Risk Analysis at Promontory Financial Group. He was formerly Senior Deputy Comptroller for Economics at the US Office of the Comptroller of the Currency (OCC), where he served as a key advisor to the Comptroller before, during, and after the global financial crisis. Mark oversaw quantitative examination support and policy research for the OCC and was closely involved in policy responses to the financial crisis, including the development of bank stress testing. As a senior regulatory official and economist, he led or participated in various Basel Committee initiatives related to economic modeling and played a leading role in the development of rules and guidance for multiple generations of the Basel capital framework. Prior to joining the OCC, Mark was Vice President for Banking Supervision and Regulation and Economic Research Officer at the Federal Reserve Bank of San Francisco, Manager of the Banking Studies Department at the New York Fed, Lecturer in Finance at the University of California’s Haas School of Business, and Senior Economist at the Reserve Bank of Australia. He has been an adviser/consultant to the World Bank, the IMF, and the central banks of Russia and Belarus.

Closing Remarks

William White is currently a Senior Fellow at the C.D. Howe Institute in Toronto. He is also an Advisor to the Council on Economic Policies. From 2009 until March 2018, he served as Chair of the Economic and Development Review Committee at the OECD in Paris. Prior to that, he spent fourteen years as Economic Adviser at the Bank for International Settlements (BIS) in Basel. In that role, he was responsible for all BIS research, data collection, and the organization of meetings for central bankers from around the world. Before joining the BIS in 1994, he was the Deputy Governor responsible for international affairs at the Bank of Canada in Ottawa.

William White is currently a Senior Fellow at the C.D. Howe Institute in Toronto. He is also an Advisor to the Council on Economic Policies. From 2009 until March 2018, he served as Chair of the Economic and Development Review Committee at the OECD in Paris. Prior to that, he spent fourteen years as Economic Adviser at the Bank for International Settlements (BIS) in Basel. In that role, he was responsible for all BIS research, data collection, and the organization of meetings for central bankers from around the world. Before joining the BIS in 1994, he was the Deputy Governor responsible for international affairs at the Bank of Canada in Ottawa.

In addition to publishing widely, Mr. White’s other activities have included membership of the Issing Committee, advising Chancellor Merkel on G20 issues. In addition to prizes awarded in Europe, in 2016 Mr. White received in Washington, D.C., the Adam Smith Award, the highest award of the U.S. National Association of Business Economics (NABE).